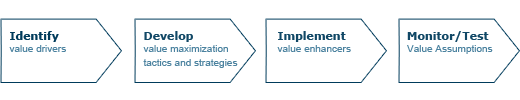

The LockeBridge Pre-Sale Consulting service was founded on the premise that most businesses would obtain higher valuations if owners had focused on polishing those aspects of their operation that drive value up prior to a liquidity transaction. The fact is that often times the businesses owned by our prospective clients are not value maximized prior to a liquidity event. As a result the stakeholders contribute substantial potential value to the buyer without recognizing any benefits of such potential. With over 20 well defined and measurable deliverables, The LockeBridge Pre-Sale Consulting process assists business owners to “stage” their companies for a liquidity event (sale or partial sale), resulting in a substantially higher value for the business.

“Anyone can compose a descriptive memorandum, but the team actually helped us to increase the value of the company through their insightful pre-sale consulting process. The process facilitated the identification of several growth areas that were perceived as highly valuable to potential buyers and resulted in a premium transaction value.”

Mr. Joel D’ Arcy

Former President and CEO Whitbread Technology Partners

Corporate Process

- Time Table – The process is designed to deliver the majority of benefits in an average of 12 months time from the date of engagement.

- Fees – All fees are quoted upfront on a fixed fee basis. No hourly fees or administrative expenses are charged. The fee may vary based upon the anticipated complexity of the engagement however 80% of all engagements are priced at our standard fixed fee rate.

The average Increase in Enterprise Value anticipated from the LockeBridge Pre-Sale Consulting engagement is 5 to 20 times the fees paid to LockeBridge.*

* Based upon prior experience. Since each engagement is unique past results may not be indicative of the individual client experience.

Individual Preparation

Income and Estate Tax – Critical Considerations

The proceeds of a transaction can only go to three places: The Seller, the Buyer or the Government. Ultimately, a successful deal is measured by how much the Seller puts in his pocket. LockeBridge not only advises on income tax minimization strategies but also offers seasoned advice in estate tax minimization, which is a major issue when selling a company and a critically important step in preserving family wealth.

Client Comment:

“The proceeds of a transaction can only go to three places: The Seller, the Buyer or the Government. Ultimately, a successful deal is measured by how much the Seller puts in his pocket. LockeBridge not only advised us on how to increase our company’s value but also on numerous issues I did not anticipate such as income tax minimization strategies. In fact, the estate tax advice provided to us by LockeBridge was nothing short of life altering and was never provided to us by our estate attorney. This advice was critically important in preserving our family wealth.”

Something Sweet, Inc., Founder and CEO