Today’s highly variable and unpredictable economy creates a large discrepancy in opinions about the future. As a result, valuation ranges are much wider than normal. It is not unusual for a company to attract a range of bids of plus or minus fifty percent as compared to a more typical plus or minus thirty percent range experienced during a more stable economy. No matter how strong your company’s performance or outlook, no company is totally insulated from macro- economic forces. In fact, the performance of most companies is highly dependent on the state of the economy including external factors such as Gross Domestic Output, Interest Rates, Balance of Trade, Consumer Sentiment and Consumer and Government Spending. This uncertainty has a significant impact on the capital raise process. Whether the raise is in the form of equity or debt or to fund early stage or mature company growth; capital’s worst enemy is the fear of uncertainty. So what can you as a business owner do? Don’t add unnecessary risk on top of the inordinate risk already existing in the economy and your industry. Focus on tactics which reduce risk such as substantial proof of efficacy, well defined business plans and milestones, and limit the amount of capital per raise while increasing the frequency.

Startup Equity Capital

For early stage companies seeking to raise equity capital, the principal variables are: Timing, Amount of the Raise and Credibility/Validity of the Business Plan. Each of these variables are highly inter-related. The primary objective of the early-stage entrepreneur/founder during the capital raise process is to manage these issues effectively, in order to retain as much equity as possible. This is especially critical during the early stages where risk is high, value is low and many entrepreneurs are scrambling to raise much needed capital, and in many instances even “survival” funding.

Timing, Credibility, Amount of Capital

No doubt that that timing of the capital raise, the amount of the raise and the credibility of the business plan are critical variables for both mature and early stage companies alike, however; for early stage companies that properly manage these variables it can mean the difference between retaining a majority of ownership versus next to nothing. Too many startup entrepreneurs have failed to manage the capital raise process effectively, only to be left with a small fraction of ownership by the time the company actually turns cash flow positive.

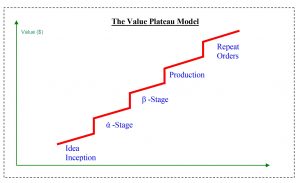

For startups there are several value plateaus during the lifecycle of the company. Obviously, the value of the startup increases as risk decreases and the business starts to achieve its major milestones or “value plateaus”. During the early stages, it is critical to identify these value plateaus. Each value plateau represents an increase in efficacy; an achievement which enhances the company’s probability of success. Timing the capital raise to be in concert with the value time line (see diagram below) is essential. This requires an extremely well thought out plan with crisp execution. It is essential to understand when and how much to raise at each plateau, and factor time-to-market into the equation. Since most early stage entrepreneurs view the capital raise process as a total defocus and “necessary evil” they want capital on the balance sheet as soon as possible. Therefore, the decision of delaying a capital raise until the next value plateau is always a sensitive trade off.

Timing the Raise

The Value Plateau Model (VPM)©. When speaking with early stage entrepreneurs, I often refer to the Value Plateau Model© (VPM), which LockeBridge created to better explain the importance of timing the capital raise and tranched financing. The word tranche is derived from the French, meaning slice or portion. In the world of investing, it is used to describe a security, either debt or equity, that can be divided into smaller pieces and subsequently sold to investors.

Tranched financings, historically used in life science companies, has expanded into other industries. Simply stated, for the entreprenuer, the principal benefit of tranching is a reduction in dilution or preservation of equity. Tranching is not for everybody, however. This type of financing requires careful structuring and is unique to every company. More conservative entreprenuers, or those that may not have the highest level of confidence in achieving their interim milestones may opt to take the full amount of required capital upfront. Word of caution; be very careful that you dont get caught in a corner by presenting an adversion to tranching. Experienced investors can easily interpret such an adversion as a material weakness in your confidence.

To best illustrate the stages of the Value Plateau Model © (“VPM”), we will use terminology which generally relates to the lifecycle of a technology-based product, however; the same concept can be applied to any product or service.

The Value Plateaus

A. Idea Inception (Seed Financing)

The first activity which generates value is the inception of an idea. Financing at this level is made to support the founder’s exploration of the idea and is referred to as seed financing. Value at this stage depends upon several factors which include the incremental benefit the idea provides to the consumer, the amount of required investment, time-to-market, barriers to entry, total available market size, etc. At idea inception, there is little or no proof of efficacy, therefore value is very low. As such, unless the idea is superior, you can count on funding coming from your own pocket or those of family and/or friends (thus the term “family & friends money”). Typical seed capital ranges between $50,000 – $250,000

B. Alpha – Proof of Efficacy in the Lab

For newly developed products, the first test of efficacy is generally conducted in a laboratory setting and referred to as alpha testing. Since there is a huge gap between lab testing and actual application of the idea in a real world environment, risk is still very high. As with the prior step, unless the idea is a blockbuster, value will still be low. The name of the game in this stage is to have highly documented, controlled testing. At the end of this stage, a prototype may be developed. The typical value for companies operating between the Proof of Efficacy and Beta stages, which have product with attractive characteristics (i.e. relatively large total available market, defensible position, growing market, good projected ROI, etc.) falls in the $2 million range. This $2M is just a general rule of thumb and can vary signficantly. A more accurate valuation methodology may be achieved by present valuing the expected free cash flow over the life of the company. Of course, the forecast itself is generally the largest variable. So, to the extent the forecast lacks credibility the present value discounted cash flow method will not be favorable. Typical discounts rates at this stage can be in excess of 70%. 1

C. Beta

Beta generally involves controlled use of the product in a third party, real-world environment. At each plateau there are varying levels of efficacy. At the Beta stage the highest level of efficacy typically occurs when an operator, working in a production environment, is operating the product without assistance from the product engineering team. When this occurs, the product is typically running effectively enough for the Company to enter into production, producing and shipping multiple systemsor componets to be used in the customers production environment. At this point, efficacy is very high. The investors’ focus now shifts more to operating and marketing issues such as customers’ perceived value and the costs of manufacturing and pricing. Although still pre-revenue, if milestones are being achieved on-time and on-budget the company’s enterprise value will have increased significantly. Typical discounts rates applied at this stage are between 50% and 70% 1

D. Production Stage (Series – A Financing)

At this stage, the company is filling orders for the product to be used in a production environment. The company is not profitable but has an organization, a working product and some revenue. At this stage, the investor is very focused on issues such as product reliability and perceived customer benefits. Typical discounts rates applied at this stage range from 40% – 60%.1

E. Repeat Orders (Series – B Financing)

One might argue that Repeat Orders really belongs in the Production Stage, however; I believe that when a customer, especially a well recognized and respected industry player, places a follow-on order it represents substantial validation of both the product benefits and the economics. After receiving several repeat orders from well-respected customers, product/technology efficacy begins to fade into the background. The focus changes from “Does the product work?” to “Does the company work?” Can the management of the company scale its operations while retaining its competitive advantage, servicing the customer needs, retaining its employees and maintain the critical operations required to be successful in the long run? Discount rates for Series – B financings typically range between 30% – 50%.1

In an effort to add some persective to the discount rate guidance, investors or buyers of mature “nano-cap” (<$50M revenue) privately held companies with solid historical performance typically seek a return on their equity in the range of 20% – 25%, depending upon such factors as the current risk-free rate of return (typically measured by the 20-year treasury bill), industry risk and perceived company specific risk.