When selling your business to a strategic buyer, a principal objective should be to identify the incremental value of the synergies created by the merge of the two entities and capture as much of that value as possible. The first step in extracting the value of the synergies is to estimate the dollar amount of value created from the synergies. As stated in the last article, synergies can come from various places such as Cost & Risk Reductions, Process Improvements, Revenue Augmentation and Economies of Scale. According to The Boston Consulting Group, 94 percent of merger announcements which disclose the value of synergies mention only cost synergies or don’t mention the specific nature of the synergies at all. 1 The principal reason for the foregoing is that cost based synergies are the easiest to quantify. For example, estimating savings from eliminating administrative redundancy, consolidating operations and increased purchasing power are relatively straight forward.

With the above stated, bolt-on acquisitions completed by larger companies often result in substantial revenue synergies. Many larger companies acquire smaller “bolt-on” companies in order to add complimentary products to their offerings, which their sales people sell to the existing customer base. Furthermore, cross selling opportunities, the potential to sell both company’s products to the other company, can materially increase the Buyer’s revenue.

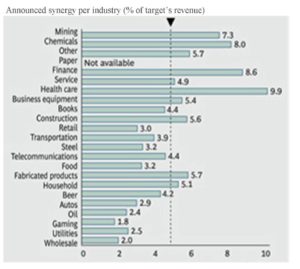

According to a 2012 study performed by Thompson Reuters, transaction synergies from a sample of 365 deals with values of more than $300 million that took place from 2000 – 2011 range from 2 to 10 percent (depending on the industry) of the target company’s latest annual sales, with a median of 4.8 percent (refer to chart below). If we assume that a similar level of synergies exist with lower mid-market transactions (i.e. transaction values less than $100M) we can infer that the synergies contribute an additional 50% or so to a typical small company’s EBITDA.2 But what if the Buyer generates billions of dollars of revenues in your market. Simply dropping your products into the hands of their salespeople can result in increasing your Company’s sales by a magnitude!