FACILITY SERVICES MERGERS & ACQUISITIONS

How have Increased Interest Rates and Volatility Impacted Valuations for FS Service Companies

Economic Summary

Economic Summary

Before addressing the question, “How have Increased Interest Rates and Volatility Impacted Valuations for FS Service Companies”, it is only prudent to review where the fight against inflation, via interest rate policy, has brought us.

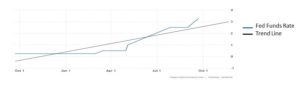

The Fed raised the federal funds rate by 75 bps to the 3%-3.25% range during its September meeting, the third straight three-quarter point increase and pushing borrowing costs to the highest since 2008. Policymakers also anticipate that ongoing increases in the target range will be appropriate which was reinforced by Chair Powell during the press conference. “We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t”. The so-called dot plot showed interest rates will likely reach 4.4% by December, above 3.4% projected in June, and rise to 4.6% next year. Meanwhile, GDP growth forecasts were revised lower to show a 0.2% expansion this year, compared to 1.7% seen in June and 1.2% in 2023, below 1.7% seen in June. Inflation as measured by PCE is seen to reach 5.4% in 2022 (5.2% projected in June) and 2.8% in 2023 (vs 2.6%). Source: Federal Reserve

Impact to Facility Services

Last quarter, in our Spring FS Update Report, we wrote: “We have witnessed substantial bifurcation within the facility services vertical. On one extreme we have material winners, such as many janitorial/cleaning companies responding to an increase in their customers’ cleaning needs in order to keep their employees and their customers safe.” This increase in demand has often offset the downturn resulting from the cancellation of major sporting events and closures of college campuses, office buildings and those venues operating in the hospitality and travel industry.

On the other hand, those FS sub-verticals where revenue is heavily weighted on the construction side, which is virtually absent of on-going maintenance services such as most mechanical and electrical services, flooring installation, masonry, etc, have suffered a substantial cash squeeze as delays have been rampant.