The terms recasting, adjusting and normalizing are often used interchangeably and refer to adjusting items on a company’s financial statements that are unrelated or unnecessary to the ongoing operations of the business. Financial reports are generally composed to minimize business tax liability which in turn, results in an inaccurate presentation of a company’s true earnings and profitability. Because the objective of reporting to the IRS is generally in contrast to financial reports composed for company shareholders and perspective investors, financial adjustments made to expose the real performance of a company usually result in higher profits and an increase in the fair market value of the business.

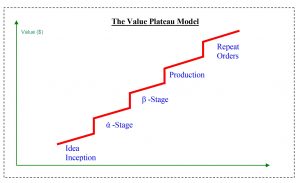

Keep in mind that buyers are paying for the company’s future expected free cash flow, not the historical financial performance. In fact, one can often hear LockeBridge bankers saying, “Learn from the past, value the future”. In other words, past performance is only meaningful in so far as it provides insight into the future potential performance of the company. Ultimately the prospective purchaser is attempting to estimate what the cash flow will be under its ownership.

There are numerous financial items that may need to be adjusted. The process is as much an art as a science. Understanding what the potential purchaser will accept as an adjustment, relevant to both the income statement and the balance sheet, requires significant experience and is a critical component in accurately estimating the value of the company.

There are a handful of categories which define the majority of adjustments. Below is a summary of these items.

INCOME STATEMENT ADJUSTMENTS

Owners Compensation

The objective is to account for the cost of all benefits received by Shareholders (passive and active) and their family members which have been expensed to the business. After accounting for the foregoing, we adjust the total compensation to the fair market rate one would reasonably expect to pay for replacement personnel.

Owner Compensation may include, but is not limited to:

- Salary

- Bonus

- Profit Sharing

- Health Insurance

- Life Insurance

- Club Membership Fees

- Personal Travel, Meals & Entertainment

- Personal Vehicle Expenses

One-Time, Non-Recurring Adjustments

Expenses and Income which are not anticipated to reoccur under the new owner’s tenor are called One-Time or Non-Recurring and may include such items as:

- Legal Expenses (e.g. litigation expense)

- Broker Fees (e.g. M&A retainer)

- Consulting/IT Projects (e.g. new web-site development)

- Non-Performing Employee Expense

- One-Time Recruiting Expenses

- Start-Up Expenses (e.g. organizational documents, patent applications, moving costs, hiring costs, etc.)

- Insurance claim proceeds and lawsuit settlements.

- Gains or losses from the disposition of assets such as the sale of vehicles.

Note that there are plenty of potential “abnormal” income and expenses which may not be intuitively obvious to business owners. An example of such are:

- Business interruption costs.

- Gains or losses from discontinued operations.

- Abnormal high or low profits (e.g. large one-time orders, inventory clearance event)

Rent Expense

If the property upon which the business operates is owned by the Company or one or more of the company Shareholders often times the rent expense is not in line with the market. If the Company owns the property only the costs associated with supporting the property such as insurance, property tax, maintenance and utilities, will be expensed without any consideration for arms-length rental rates. If the purchaser is not acquiring the real estate the property expenses must be adjusted to fair market. Even if the property is being sold along with the operating entity, because the method used to value real property differs from the methods employed to value operating entities, the real property cost must be normalized to fair market so that each of the two assets can be valued independently.

BALANCE SHEET ADJUSTMENTS

The profit and loss statement is generally much better understood and garners more attention by business owners than the balance sheet. Consequently, balance sheet adjustments are often overlooked.

Regardless of the depreciation method used assets need to be “marked to market”. Mark-to-market accounting can change values on the balance sheet as market conditions change. For example, your 20 year-old desk may be fully depreciated and show no value on the balance sheet but it works just as good today as it did when it was new. In fact, it may even be valued higher today than the original purchase price. For profitable going concerns the value of the fixed assets generally does not impact the enterprise valuation, however what about the value of the inventory.

Depending on both the inventory accounting method utilized and the type of assets held in inventory, a mark-to-market adjustment can substantially impact the enterprise value.

LockeBridge does a significant amount of business in the metal industry. Consider a metal processing company using LIFO. In this case there should be a LIFO reserve footnoted on the financial statements. Depending upon the company’s inventory turn-over and the volatility of metal commodity prices adding back the LIFO reserve can substantially change the value of the current assets. Even if FIFO is used consider a metal recycler, for example, which may need to accumulate enough inventory to fill a shipping container to be sent to a Chinese buyer. It may take a smaller recycler several months to accumulate this volume. During such accumulation period recent metal prices may differ significantly then the recorded cost of the inventory.

Various factors must be considered in valuing a company. One such factor is how much weight to be placed on a cost-based methodology such as the replacement cost method. In any event, accurately adjusting the balance sheet may be essential in valuing the company.

ENTERPRISE VALUE

After accounting for all of the relevant adjustments, how does one then determine the value of the company? Thorough and credible adjustments are a critical factor in any valuation but even if the job is done perfectly there are many other factors to consider when valuing a company.

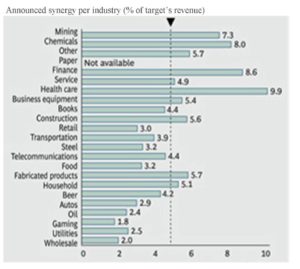

For example, most business owners are familiar with the concept of EBITDA “multiples”, and sometimes applying these multiples to a properly adjusted EBITDA can indeed approximate market value, however there are several other variables to consider.

Consider two shipping companies both with the same EBITDA, but one company leases their trucks and the other purchases their trucks. Because the leasing cost is already accounted for as an expense, most likely the company that leases has a higher value. Even if both companies purchase their trucks the company with the lower capital expenditure, all else equal, will be valued higher. Capital expenditure doesn’t come into play when considering EBITDA. That’s why free cash flow (FCF) is really the relevant number. Most non-professionals, and many professional for that matter, do not fully understand FCF because it takes into account more complex issues such as capex, debt leverage, and tax rates.

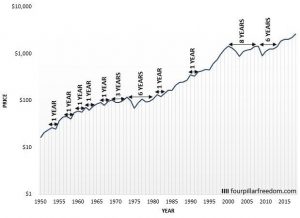

As previously mentioned, purchasers value the future expected FCF. To do this they project the entity’s adjusted earnings into the future and then “discount” or “present-value” them back into today’s dollars using a discount rate which accounts for their cost of both debt and equity, the weighted average cost of capital (WACC). One critical job of the valuation professional is to estimate the prospective purchasers WACC. The methodology used for such estimation varies widely and is often the determining factor in the valuation accuracy. A discussion of the various methodologies used to determine WACC is beyond the scope of this paper but suffice it to say that the WACC is based on numerous factors including, but not limited to:

- The Risk Free Rate of Return

- Small Company Risk

- Industry Specific Risk

- Company Specific Risk

- Availability and Cost of Debt (i.e. leverage)

- Forecast Credibility

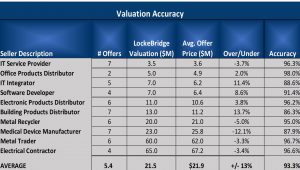

This article has mentioned only two valuation methodologies, the replacement cost method under the cost approach and the discounted cash flow method using the income approach, however a number of methods should be considered to accurately value a company. Each method has its strengths and weaknesses. Refer to below Appendix for LockeBridge Valuation Accuracy.

THE BOTTOM LINE

No owner one should enter into the merger and acquisition (M&A) process prior to obtaining a very credible estimate of value. It is critical that selling Shareholders have reasonable and relatively accurate expectations, which reflect how the market perceives the value of the company. Additionally, if not credibly performed Shareholder’s can be subject to a material conflict of interest with their M&A Advisors, whose compensation is usually substantially based upon the value and structure achieved. Refer to www.lockebridge.com/engaging-an-investment-banker for a brief discussion of potentially advisor conflicts.

Both offer prices and valuations can range substantially. Refer to www.lockebridge.com/case-studies to see numerous sell-side transactions, bid prices and composition. Here you can see that it is not uncommon for offers to range +/-30% or even more.

The M&A process is not to be taken lightly. It should be done effectively and optimally, the first time around. Obviously, unanticipated circumstances out of the control of both the Advisor and Owner can and do occur, however a failed process requiring the business to be placed back on the market a second or even third time is rarely a good thing. An offensive position the first time around can easily morph into a defensive posture. An accurate estimate of value and an effective selling process should minimize the time, energy and potential defocus and exposure which can all result in substantial costs to both the Shareholders and the Advisor.